I never get why people want to invest their money in the stock market. It’s like the only best place to put your money in hopes of enormous returns. So is investing in stocks really worth it?

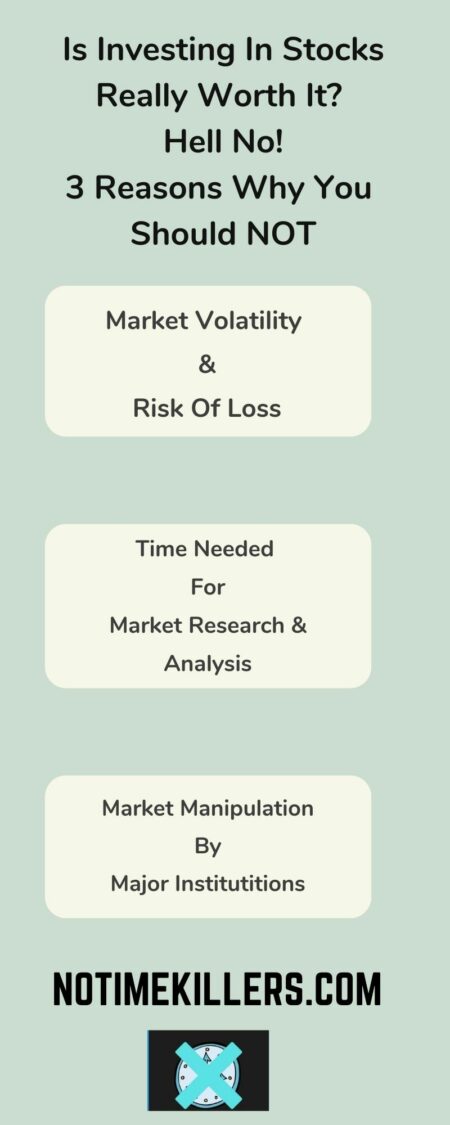

Based on the high risks involved and recent market volatility, it’s definitely not worth it.

If you don’t understand how stocks work, it’s more likely you’ll lose money than get big returns on your investment.

It’s why I encourage you to not invest in stocks at all.

Yes, you read that right. I think it’s best you stay from the stock market- period.

In this post, I’ll give a good analogy to how the stock market works. Followed by that, I’ll lay out three primary reasons why to stir away from the market.

I offer a much better recommendation near the end of this post. I think it’s far much better for your overall health as well- financially, emotionally, and mentally.

Note: We may include products or services that will be helpful to our readers. This post may contain affiliate links. For more information, please review the affiliate disclosure page.

- The Stock Market Is Like Growing A Garden

- It’s Not A Perfect World

- Market Volatility And Risk Of Loss

- Time Needed For Research And Analysis

- Control And Manipulation By Major Financial Institutions

- Are Stock A Good Investment? My Viewpoints

- What I Recommend For Passive Income- Building Long-Term Wealth For You

The stock market is like growing a garden

For those who don’t have a deep grasp of the stock market, let’s give a simple analogy.

Let’s say you want to plant a garden. You pick the seeds (stocks) you want to plant. You then plant them in fertile soil, which is the equivalent of a well-researched portfolio.

Every now and then, you take care of your plants by watering them and putting them out in the sun. We can compare that to adjusting and watching your investments grow (or not).

With time, patience, and effort, your garden will grow and result in fruits. The big garden is your diversified investment portfolio, whereas the fruits planted are your returns.

It’s not a perfect world

But that may not always be the case. There’s the possibility of unpredictable weather or insects that can damage your plants.

In the stock market, there’s always the risk of market volatility or manipulation that can have an impact on your investments.

As much as we want to think of it, investing in stocks does not guarantee big returns.

When in fact, it’s likely you’ll end up losing money than making money. That’s if you don’t know what you’re doing.

Is investing in stocks really worth it?

Due to recent market volatility and manipulations, investing in the stock market is very risky to go into.

Besides the potential for losing a good chunk of your money, there’s time and effort needed for researching which stocks to invest in.

Some people may not have the time to read perspectives or have the money to invest in particular stocks.

Reasons to not invest in the stock market

Market volatility and risk of loss

In recent years, the stock market has had mixed results: Sometimes, it can be volatile, while other days it can have short-term rallies.

But the big problem is those volatile periods when some stocks can lose a lot of value on a single day. That’s when investors can lose a significant portion of their money.

Some of the biggest stock market crashes that have taken place include the following:

- The Panic of 1907

- Wall Street Crash Of 1929 (catalyst for the Great Depression)

- Black Monday (1987)

- Crash of 2008-2009 (catalyst for the Great Recession)

- Crash of 2020 (catalyst for the COVID-19 recession/lockdowns)

Curious about starting your own online business but don’t know where to start? I encourage you to check out my top recommendation for launching your journey.

Just me and a supportive community who are ready to help YOU succeed.

It’s the real deal- simple.

Take a Free TEST DRIVE to see if it’s the right fit for you. No pressures and no need to pull out your credit card.

We’ll connect on the other side.

The time needed for research and analysis

When making investments in stocks, it’s equally important to research and analyze which ones to put money in.

For someone brand new to investing, that may require a big learning curve to overcome. If they’re crunched on time, they may fall short of making the best decisions possible.

If you’re not able to stay updated on the latest trends and analysis, you may end up not making the best decisions for your investment portfolio.

Can you really make money with stocks?

You can make a good return from stocks each year, but not that much. If you’re a long-term investor, you could possibly make huge returns if you’re able to stick with it long enough.

But if you’re going in and out of the stock market, you may make little returns on your initial investments.

Control and manipulation by major financial institutions

Not many people realize there are major players who play a significant role in manipulating financial markets.

Probably the biggest institution is the Federal Reserve. As the central bank of the United States, it’s in charge of the nation’s monetary policies.

These policies range from raising interest rates to making credit available to borrowers and lenders, and it impacts consumer spending as well.

I believe that the Federal Reserve (the Fed) plays an influential role in the stock market. The reason is they have the ability to print money out of thin air and pump it into the U.S. stock market.

In effect, that artificially raises the prices of some stocks. Although that can feel good for investors in the short term, it distorts the real prices of what these stocks should be.

The decisions made by the Fed may be of good intentions, but they can spell disaster in the long run.

I won’t go into too much on my criticisms of the Fed, but the fact this central bank has so much control of the economy is beyond my imagination.

Major bank manipulated the precious metals market

Most recently, JPMorgan was accused of manipulating the precious metals market a while back.

Back in September 2020, the bank admitted to committing wire fraud in regard to precious metals and US treasuries.

The firm agreed to pay $920 million in regard to these schemes and spoofing these markets.

A relevant article from notimekillers.com

Read next on “Why Do Startups Lose Money? 5 Reasons For The Loss“, to understand why startups can lose more money than they anticipate.

Are stocks a good investment? My viewpoints

Based on these reasons mentioned, I truly don’t see stock as the best investment for anyone. That’s especially true for beginners.

I’ve interacted with a lot of people that are interested in the stock market. But at the same time, I’m puzzled by why they just want to put their hard-earned money into something they have no control over.

Unless you understand the markets and you’re willing to accept the risks, I strongly recommend not going down that route.

There are other ways to build wealth besides investing in the stock market. It seems that the stock market is the most obvious one for building long-term wealth.

What I recommend instead for passive income: Building long-term wealth for you

Rather than look into the stock market, there are simpler ways to learn how to earn passive income.

One thing I’ve been doing is blogging and building a niche website that I enjoy doing. Many people may not realize that it’s a great long-term strategy to grow wealth exponentially.

Let me briefly explain: Building a niche website takes a lot of hard work and effort.

Check out the latest price on Amazon

But if done correctly, you can make bigger returns than say investing in stocks such as the Dow Jones and the S&P 500.

Initially investing in a blogging business is not risky as the stock market. You can invest as little as under $1000 a year.

Plus, you don’t risk losing all of your money if things go south. There’s not much volatility when it comes to the blogging side of things.

I would argue you have more control because you’re treating it like your own business. You certainly have control over where your money will be invested in- if done properly.

Where to go if interested

If you want to learn more about how blogging and building niche websites work, I encourage you to check out my top recommendation for getting started.

This platform is the best place for beginners and truly teaches you the basics of running an online business.

You can start today by signing up for a free starter account. Give it a test drive and see if it’s the right fit for you or not.

The first five lessons of the core training are free, so make the most out of that training.

Final Words

Investing in stocks is not the best place to invest your hard-earned money.

With market volatility, the time required for research and analysis, along with market controls and manipulations, it’s hard to control how your money will be invested.

Luckily, there are better solutions to investing in stocks. Building passive income via blogging and niche websites is significantly less risky while being fun as well.

If you’re interested in giving a test drive, check out my top recommendation on getting started in that area.

Take more control over your money elsewhere besides in a current unstable, risky stock market.

Your Turn: Is it worth investing in stocks?

I would like to get your thoughts on this topic. Is investing in stocks a good way to build long-term wealth?

What are some reasons you think that may be? Or is it not?

What other areas could you invest your money in? Could it be what I recommended earlier, or somewhere else?

Feel free to share your thoughts by leaving a comment below. I look forward to reading your responses, and I’ll gladly respond promptly.

If you got value from this article, please bookmark this website to visit later for new posts every week. Spread the word to others. Sharing is caring! To get more of this type of content, you won't want to miss out my daily email letters. These are worth some golden nuggets and best tips to help you in your business. Sign up today! Count me in on the daily letters via email! For the latest videos that come out every week, subscribe to the YouTube channel. Also, be sure to check out our new space on Twitter X! YouTube Twitter (X) Medium Profile

Eric is the owner and chief editor of notimekillers.com. He takes great pride in helping people manage their time and grow their businesses. Eric is a firm believer in financial and time freedom, as he believes in financial independence and taking ownership of your time. “Time is your most important asset. It can be your best friend or worst enemy. How you use your time can shape the future you desire to have.” In his leisure time, Eric loves to write and read whenever possible. He enjoys going for long walks outdoors while doing in-home workout videos every week. You can also connect with Eric via LinkedIn.