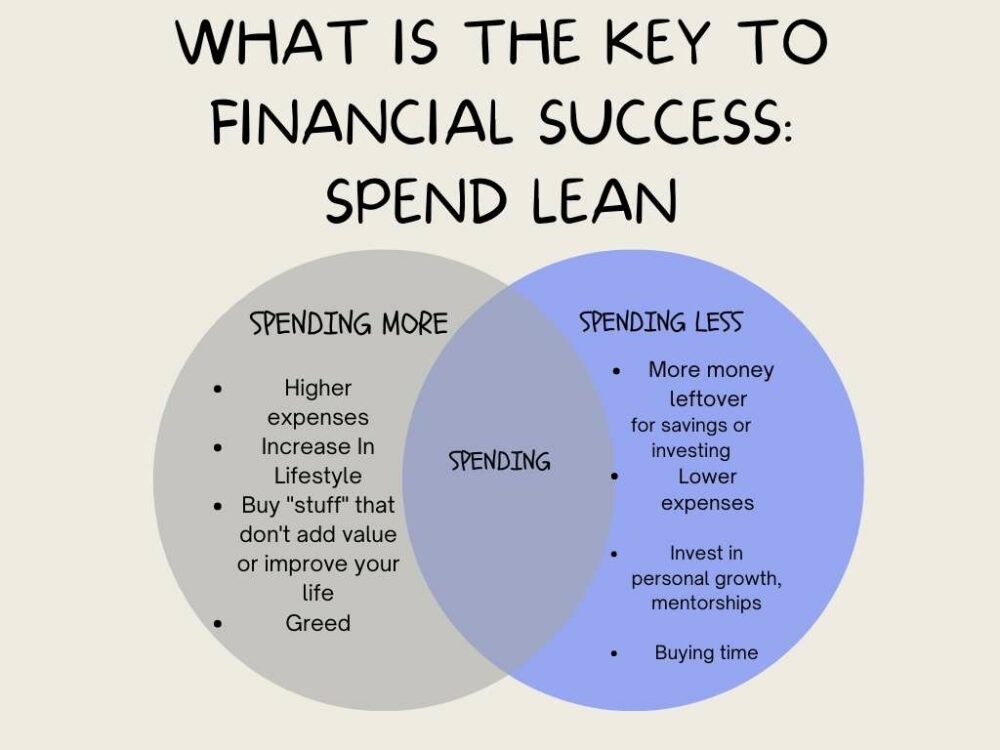

Do you struggle with finances in general? Whether it’s your personal finances or managing a business, it’s critical to get your finances in shape. So what is the key to financial success? One big part of it is to have lean spending habits (or lower your expenses).

It may be easier said than done, but anyone can do it with the right mindset. In this article, I’ll discuss the general problem with spending, as it’s become a bigger problem over the years.

Along with the spending problem, I’ll briefly explain two parts where spending can be reduced (either as an employee or an employer). For the most part, we will focus on lowering spending for a better financial outcome in the long term.

The spending problem

For the most part, people will either live within or go above their means. For example, they may spend most of their paychecks right away, or use credit cards to buy things they don’t need.

When it comes to public finance, we refer to that as discretionary spending– meaning spending on things that are not always necessary. People will spend things they do not need now, but it’s considered extra money leftover to use.

When that happens, there’s not much left over for saving or investing in other areas. Investing the remainder of your money is another key component of personal finance.

Additionally, it puts people at financial risk in the event unexpected events take place. If they don’t have an emergency fund (or have little funds in one), they put themselves at risk of financial problems ahead.

What is a good financial situation?

- Financial stability includes a lower cost of living and a steady cash flow (for businesses). A great financial position is one that leaves you with more money each month.

Addressing the spending problem

Back to the main topic of this post, we need to remain lean on spending habits. Rather than increasing your lifestyle, prioritize lowering your expenses.

Let’s lay out a few examples of how that plays out:

An employee getting a pay raise

Most of the time, the immediate reaction is to think about what someone can buy with more money. The thoughts of greed sets in, which can lead to increasing their spending habits.

Most employees will opt to increase their lifestyles (i.e. bigger house, fancy car, bigger TVs, etc.). Instead, the goal should be to keep lowering living expenses as much as possible.

A business owner

If you run a business, prioritize spending on what you need. It’s important to lower your operation costs, and of course, make sure to pay your employees and put money aside for taxes ahead of time.

But whatever revenue you earn should be used to grow your business further. Small things such as a company logo or business cards shouldn’t be priorities for your business. Especially if your business runs online, business cards may not be necessary to spend on.

You may have heard of the concept, “pay yourself first”. I won’t go over it in great detail here, but the idea is to put more money aside for investing or saving.

Investing is a critical component of financial success. Don’t spend on expenses or anything else until you’ve taken care of that.

Final Words

It can be challenging for some people to spend less than they earn. It’s tempting for someone wanting to spend most (if not all) of their paycheck.

However, starting that good habit now will help in the long run. It certainly will help your financial situation improve over time. If you’re able to keep your spending low, you’ll have more money left over to save or invest in things that interest you.

One example is starting your own little business. Even if it’s on the side, investing some money into it can produce better returns if you put the time and effort into it.

Overall, if you can lower your expenses (personal or business), financial success can be easily achieved. It all comes down to having the right mindset, especially when it comes to money.

Your Turn: Do you struggle with your spending habits?

I would like to get your thoughts on this topic. Do you struggle with lowering your spending costs? Does much of your income go toward paying living expenses?

Have you experienced a situation where you had those feelings of greed? Or do you prioritize saving and investing most of your income?

If so, have you been successful with those good financial habits? What challenges have you overcome?

Feel free to share your thoughts by leaving a comment below. I look forward to reading your responses, and I’ll gladly respond promptly.

If you got value from this article, please bookmark this website to visit later for new posts every week. Spread the word to others. Sharing is caring! To get more of this type of content, you won't want to miss out my daily email letters. These are worth some golden nuggets and best tips to help you in your business. Sign up today! Count me in on the daily letters via email! For the latest videos that come out every week, subscribe to the YouTube channel. Also, be sure to check out our new space on Twitter X! YouTube Twitter (X) Medium Profile

Eric is the owner and chief editor of notimekillers.com. He takes great pride in helping people manage their time and grow their businesses. Eric is a firm believer in financial and time freedom, as he believes in financial independence and taking ownership of your time. “Time is your most important asset. It can be your best friend or worst enemy. How you use your time can shape the future you desire to have.” In his leisure time, Eric loves to write and read whenever possible. He enjoys going for long walks outdoors while doing in-home workout videos every week. You can also connect with Eric via LinkedIn.

This one is a hot topic in my house lately. Definitely not easy to cut back when you feel like you don’t have it.

The mindset is a huge factor the outside pressures to keep your kids with the best equipment. I’m a work in progress- very well put together, I enjoyed reading.

Hi John,

Cutting back on spending habits is not easy for a lot of people; however, it’s necessary to achieve financial success down the road.

Mindset is a big one to keep in mind. Having the right mindset can help with tackling bigger issues. So I’m glad you have that to work on and look forward to.

Thank you very much for sharing your thoughts- they’re greaty appreciated.